Your savings deserve to grow.

Discover how an everyday interest rate can fast-track your financial goals.

Interest rates play an integral role in helping you reach your financial goals, as the interest earned on your savings helps bring those goals within reach.

On average, people take 1-2 years to save for mid-range goals like a big vacation, home reno, or major appliance purchase. That's why choosing the right savings account is key to making your money work harder for you.

Our best everyday rate, designed to help you get where you’re going

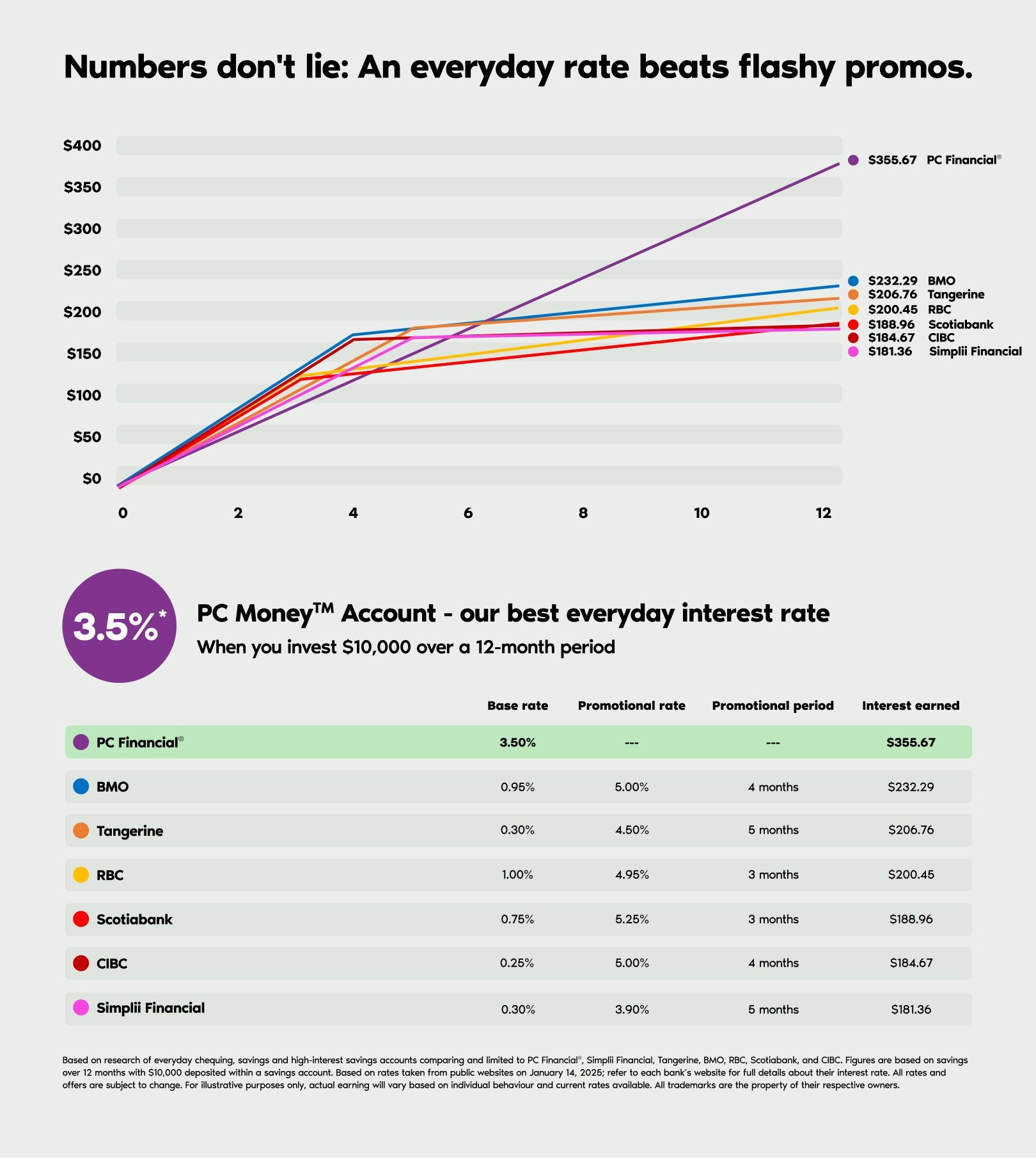

The PC Money™ Account savings feature is committed to giving you consistent, long-term value with a competitive everyday interest rate. That means no promotions, and more importantly, no gimmicks. Just a long-term rate that you can build your savings goals around.

Unlike some banks that offer limited time promotions (more on that later), our best everyday rate is free from sharp drops, so you get everyday growth that can help you reach your goals with confidence.

The Bank of Canada’s role in interest rates

The Bank of Canada continuously monitors how the economy is performing and adjusts interest rates to help keep things stable. But what does this mean for your money? To help make sense of this, imagine the economy is your home, inflation is the temperature, and the Bank of Canada is the thermostat trying to get it just right. When inflation is in full swing, they raise the rates to encourage saving. When it’s cooling off, they cut the rates to encourage spending — helping boost the economy. As Canadians, we’d all love to see a strong economy. But lower interest rates also affect the return on savings, which will directly impact how much you can earn during these times.

Do interest rates on savings accounts change?

Like all banks, we periodically review and adjust our own rate in response to several factors including market trends and competitors, but the Bank of Canada benchmark rate is a key factor. Even as rates fluctuate, we'll keep our commitment to staying competitive and helping you reach your savings goals. Unlike many other banks, there are no dramatic rate drops here!

If it seems too good to be true, it probably is

Some banks offer big, flashy promotional interest rates—and they’re enticing—we get it. But these promos put you in a position where you’re chasing returns and making hasty financial decisions. And while they offer high interest rates up front, they often require a large balance to qualify for an advertised rate, a lock-in period where you can’t access your money, and to top it off, the rate plummets at the end of the promo period.

How drastic could this drop off really be?

Let’s look at an example to demonstrate the peak and valley effect of diminishing returns after the promo ends:

If you have a 5% interest rate, a $10,000 deposit will earn you $500 in one year. Assuming interest is calculated daily and paid monthly on your savings balance, you will receive about $41.66 monthly.

Once the promo period ends and the 0.5% rate kicks in, you’re looking at around $4.16 each month.

That’s what we mean when we say dramatic drop off.

If we go back to the average 1-2 years people take to save for mid-range goals, it’s clear these short-term bursts of interest aren’t likely in line with your goals.

What you see is what you get with the PC Money™ Account

While our rate isn't promotional, it is subject to change from time to time.

Our best everyday rate, no catches is a promise to stay competitive today and every day.

It is the opposite of the too-good-to-be-true rates — continuously growing your returns without any dramatic drops after the introductory terms end.

So, what do we mean by no catches? This means:

No minimum balance needed to take advantage of our PC Money™ Account savings feature.

No monthly fee1 eating away at your savings.

No commitment required standing between you and access to your money.

Your interest is calculated daily and paid out monthly, starting from day one. And the best part—there’s no cap on the interest you can earn!

And it’s not just the money in your savings that works harder. The PC Money™ Account earns you PC Optimum™ points on everyday banking too. That means points for getting paid4, paying bills5 and every dollar spent when you shop6. Throw that in the mix with no monthly fee and you’re looking at an average of $700 in annual value3. Plus, you get free unlimited everyday transactions2.

A bank account that helps you with your spending and savings goals? Now that's a win-win!

Legal Stuff

General information not about PC Financial® products is provided for your reference and interest only. The above content is intended only to provide a summary and general overview on matters of interest and is not a substitute for and should not be construed as the advice of an experienced professional. PC Financial® does not guarantee the currency, accuracy, applicability, or completeness of this content.

*Interest is calculated daily at the current rate on the total closing savings balance in the PC Money™ Account and paid monthly to the savings balance. It is a simple interest calculation. Interest rates are annual and subject to change without notice. Visit pcfinancial.ca for current rates and more information. The PC Money™ Account savings feature is currently unavailable to residents of Quebec.

1Information about fees for special requests and services for the PC Money™ Account is available here.

2Everyday transactions include an unlimited number of completed electronic fund transfers, withdrawals at PC Financial® bank machines, self-serve bill payments and purchases in Canadian dollars. For information about daily and transactional dollar value limits on everyday transactions, and fees for other available transactions/services, please see here.

3Value shown is for illustrative purposes only; results may vary based on individual purchase behaviour and savings. Up to $700 annual value includes:

Up to $60 in points annually: Earn a monthly bonus of up to 5,000 PC Optimum™ points when you deposit funds to your PC Money™ Account using automatic payroll or pension direct deposits. Payroll or pension deposits totaling between $1,500 and $2,999 within a calendar month will earn a bonus of 2,000 PC Optimum™ points, and deposits totaling greater than $2,999 will earn an additional bonus of 3,000 PC Optimum™ points, for a maximum monthly bonus of 5,000 PC Optimum™ points. Limited to one bonus per customer, per month, even if you have multiple PC Money™ Accounts. The classification of a direct deposit as a payroll or pension direct deposit is determined solely by President’s Choice Bank. Interac e-Transfer® services, electronic funds transfers, and other forms of deposits or transfers to your account do not count towards this bonus. Bonus points will be awarded to your PC Optimum™ account within 2-7 business days of when you meet the minimum direct deposit amount(s).

Up to $60 in points annually: Earn a bonus of 1,000 PC Optimum™ points for each of up to five bill payments of $50 or more to unique payees, per calendar month, made using a valid PC Money™ Account. Bonus points will be awarded to your PC Optimum™ account within 2-3 weeks of a successful bill payment.

Up to $80 in points annually when you use the PC Money™ Account as your primary spending account: Spending estimate of $1,166.67 monthly (with 15% spent at eligible stores and 85% spent everywhere else) is based on 2023 annual purchase data of PC Money™ Account holders who use the account as their primary spending account. Earn at least 5 PC Optimum™ points per dollar on qualifying purchases with your PC Money™ Account, wherever your card is accepted. Earn 10 PC Optimum™ points (5 regular PC Optimum™ points plus a bonus of 5 PC Optimum™ points) per dollar on qualifying purchases at participating Loblaw banner stores, Shoppers Drug Mart® stores, Joe Fresh® stores, and Esso™ and Mobil™ stations in Canada. Bill payments, electronic funds transfers, account fees and interest are not qualifying purchases for the purpose of earning PC Optimum™ points. PC Optimum™ points will be deducted for any credits or returns. President's Choice Bank reserves the right to cancel, change or extend regular and bonus points earning rates at any time. Account must be in good standing at time of qualifying transaction and awarding of points. Value shown is for illustrative purposes only; results may vary based on individual purchase behaviour.

An estimate of $300 in interest earned on your savings balance, calculated using a simple interest calculation and assuming a minimum annual interest rate of 3.35% and a daily closing savings balance of $8,950. Savings feature not currently available in Quebec.

Up to $200 in savings annually: Savings on monthly fees based on an average of moderately priced, unlimited transaction chequing accounts at the big 5 Canadian banks. Some banks may rebate or waive monthly fees for customers who hold multiple products or maintain a minimum account balance each month.

4Earn a monthly bonus of up to 5,000 PC Optimum™ points when you deposit funds to your PC Money™ Account using automatic payroll or pension direct deposits. Payroll or pension deposits totaling between $1,500 and $2,999 within a calendar month will earn a bonus of 2,000 PC Optimum™ points, and deposits totaling greater than $2,999 will earn an additional bonus of 3,000 PC Optimum™ points, for a maximum monthly bonus of 5,000 PC Optimum™ points. Limited to one bonus per customer, per month, even if you have multiple PC Money™ Accounts. The classification of a direct deposit as a payroll or pension direct deposit is determined solely by President’s Choice Bank. Interac e-Transfer® services, electronic funds transfers, and other forms of deposits or transfers to your account do not count towards this bonus. Bonus points will be awarded to your PC Optimum™ account within 2-7 business days of when you meet the minimum direct deposit amount(s).

5Earn a bonus of 1,000 PC Optimum™ points for each of up to five bill payments of $50 or more to unique payees, per calendar month, made using a valid PC Money™ Account. Bonus points will be awarded to your PC Optimum™ account within 2-3 weeks of a successful bill payment.

6Earn at least 5 PC Optimum™ points per dollar on qualifying purchases with your PC Money™ Account, wherever your card is accepted. Earn 10 PC Optimum™ points (5 regular PC Optimum™ points plus a bonus of 5 PC Optimum™ points) per dollar on qualifying purchases at participating Loblaw banner stores, Shoppers Drug Mart® stores, Joe Fresh® stores, and Esso™ and Mobil™ stations in Canada. Bill payments, electronic funds transfers, account fees and interest are not qualifying purchases for the purpose of earning PC Optimum™ points. PC Optimum™ points will be deducted for any credits or returns. President's Choice Bank reserves the right to cancel, change or extend regular and bonus points earning rates at any time. Account must be in good standing at time of qualifying transaction and awarding of points.

.jpg)